#Best personal finance software for budgeting, mac free

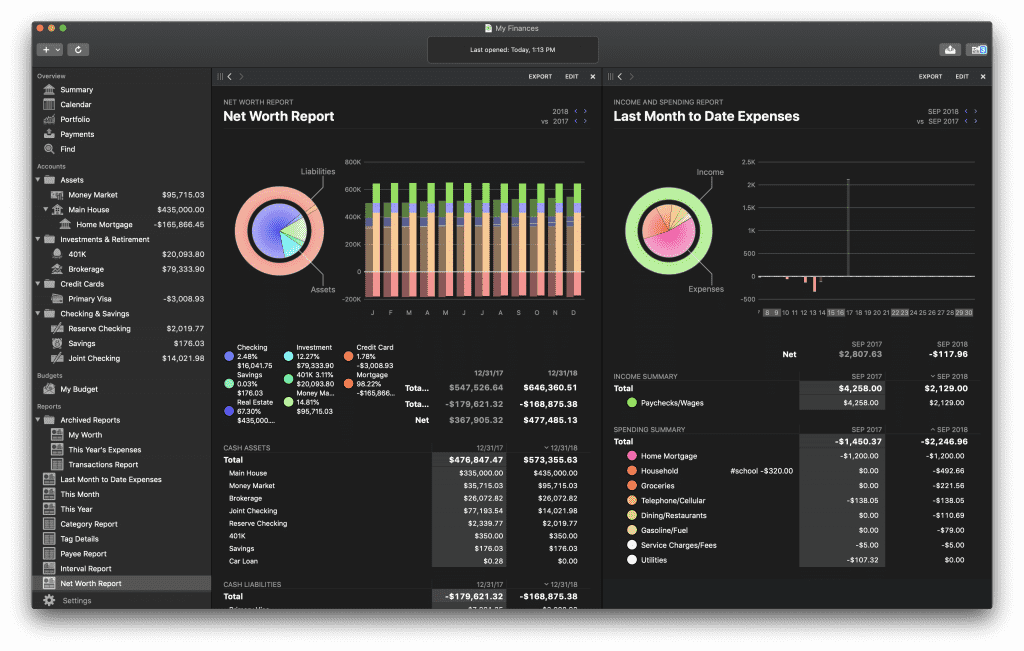

Other financial resources: Some programs provide a free credit score, investment tracking, net worth tracking, and more.Reporting: The software you use should create charts and graphs showing your spending patterns.Most software comes with some preset categories, but you should also be able to add your own. Spending categories: Budgeting software may automatically characterize your transactions or you may have to do it manually.However, you must provide your financial credentials so the program can access your bank and credit card transactions and aggregate them. Account linking: Linking your accounts to your software means you don't have to upload transactions to monitor your spending and see if you're staying on budget.When you are looking for budgeting software, key features to keep in mind include: Tracks spending, net worth and spending on one dashboard, automatic categorization of transactionsġ0 digital envelopes for organization, allows users to manually import bank transactions and move funds between envelopes Links all accounts, including retirement investmentsĭigital envelope, automatic budgets, tracks and reports spending, a digital wallet with an annual savings bonus (upgraded service only) Track spending, monitor investment performance in real-time, set retirement goals, and track your net worth You can link your financial accounts with paid version IOS and Android, and desktop/laptop computers Syncs in real time, customizable template, access to online courses IOS and Android, and desktop/laptops computers Provides spending alerts and cash availability in real-time, organizes expenses

Track spending, customizable alerts, and communication tools Links with all financial accounts (credit cards, checking, saving, etc.) IOs and Android, and desktop/laptop computers Linked accounts, budgeting tools, 100+ online workshops Cash back ranges from 10% to 20% and covers purchases like gas, food delivery, groceries, and other common merchants. However, if you want the Albert Genius add-on, which boosts your savings bonus and provides access to financial guidance over text messages, you'll have to pay a minimum of $4 per month.Įarn cash back when you use your Albert debit card. You'll be rewarded with an annual bonus on your savings and can easily track savings goals. You can instantly see your income, bills, and the money left over. You'll also have many reporting options including reviewing past months' budgets or seeing your transactions as a pie chart.Īlbert not only facilitates easy budgeting but also makes saving effortless by identifying when there's extra money available and moving it into a digital wallet. Limited educational information about the budgeting processĪlbert creates an automatic budget for you, helping you to identify where your money is going at all times.

0 kommentar(er)

0 kommentar(er)